Genral Insurance

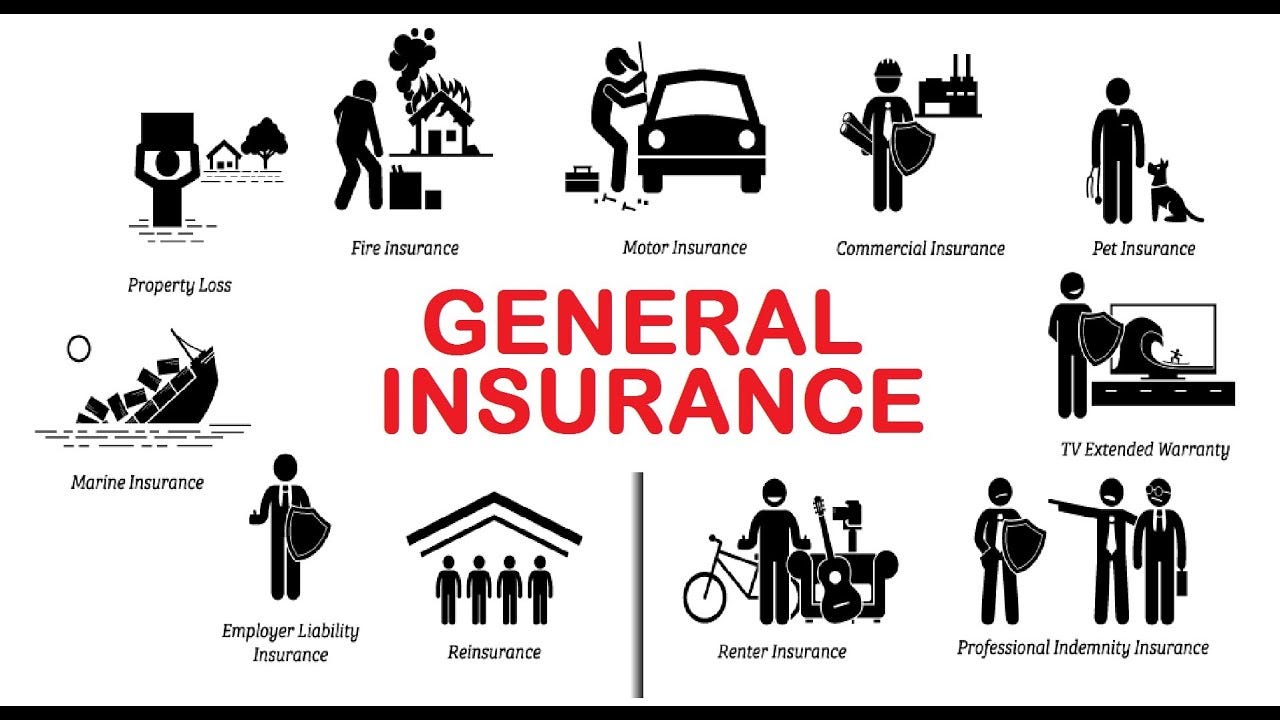

What is General Insurance?

General insurance, also known as non-life insurance, provides financial protection against losses and damages other than life. It covers various risks such as accidents, property damage, health issues, and liability claims. Unlike life insurance, which pays out upon the insured’s death, general insurance policies typically offer coverage for a specific period and can be renewed upon expiration.

Types of General Insurance

- Health Insurance: Covers medical expenses for illnesses, injuries, and other health-related issues.

- Motor Insurance: Provides coverage for vehicles, including cars, motorcycles, and commercial vehicles. It includes:

- Third-Party Liability Insurance: Mandatory by law, covers damages and injuries caused to others.

- Comprehensive Insurance: Covers third-party liability, as well as damages to your own vehicle.

- Home Insurance: Protects against damages to your home and its contents due to fire, theft, natural disasters, and other risks.

- Travel Insurance: Covers risks associated with traveling, such as trip cancellations, lost luggage, medical emergencies, and more.

- Personal Accident Insurance: Provides financial compensation in case of accidental death, injury, or disability.

- Commercial Insurance: Offers various coverages for businesses, including property insurance, liability insurance, and worker’s compensation.

- Marine Insurance: Covers loss or damage of ships, cargo, terminals, and any transport by which property is transferred, acquired, or held between points of origin and final destination.

- Liability Insurance: Protects against legal liabilities arising from injuries or damages caused to third parties.

Key Components of General Insurance

- Premium: The amount paid by the policyholder to the insurance company for the coverage.

- Policy Term: The duration for which the insurance coverage is valid.

- Sum Insured: The maximum amount the insurance company will pay for a covered loss.

- Deductible: The amount the policyholder must pay out of pocket before the insurance coverage kicks in.

- Coverage: The specific risks and events that are covered by the insurance policy.

- Exclusions: The specific risks and events that are not covered by the insurance policy.

- Claim: A request made by the policyholder to the insurance company for payment of a covered loss.

- Policy Renewal: The process of extending the insurance coverage beyond the initial policy term.

How General Insurance Works

- Application: The policyholder applies for an insurance policy, providing necessary details and selecting coverage options.

- Underwriting: The insurance company evaluates the application to assess the risk and determine the premium.

- Policy Issuance: The insurance company issues the policy once the application is approved and the premium is paid.

- Policyholder Responsibilities: The policyholder must pay the premium regularly and comply with the policy terms.

- Claim Filing: In case of a covered event, the policyholder files a claim with the insurance company.

- Claim Settlement: The insurance company reviews the claim, and if approved, pays the sum insured to the policyholder or the beneficiary.

Benefits of General Insurance

- Financial Protection: Provides financial support in case of unforeseen events and losses.

- Peace of Mind: Reduces stress and anxiety by mitigating financial risks.

- Legal Compliance: Some types of insurance, like motor insurance, are mandatory by law.

- Risk Management: Helps in managing and transferring risks to the insurance company.

- Business Continuity: Ensures that businesses can recover from unexpected losses and continue operations.

Important Considerations

- Coverage Needs: Assess your needs and choose coverage that provides adequate protection.

- Premium Costs: Compare premiums from different insurers to find affordable options.

- Exclusions and Limitations: Understand what is not covered by the policy.

- Claim Process: Familiarize yourself with the claim filing process and documentation requirements.

- Insurance Company Reputation: Choose a reputable insurer with a strong track record of claim settlements.

Steps to Choose the Right General Insurance Policy

- Identify Your Needs: Determine the types of coverage you require based on your risks and assets.

- Research and Compare: Compare policies from different insurers based on coverage, premiums, and terms.

- Check Eligibility: Ensure you meet the eligibility criteria for the chosen policy.

- Read Policy Documents: Carefully read the policy documents to understand coverage, exclusions, and conditions.

- Consult an Advisor: Consider consulting an insurance advisor for personalized recommendations.

- Purchase the Policy: Complete the application process and pay the premium to activate the policy.

- Review Regularly: Regularly review your insurance coverage to ensure it continues to meet your needs.

Conclusion

General insurance is essential for protecting against various risks and uncertainties. By understanding the different types of general insurance, key components, and factors to consider, you can choose policies that best suit your needs and provide financial security.